IC Markets Review : World's Biggest Broker ?

IC Markets Review

IC Markets Information

IC Markets is Australia’s biggest online trading firm, offering trading services to both experienced day traders and scalpers as well as newcomers. Clients of IC Markets benefit from cutting-edge trading platforms, low latency connection, and outstanding liquidity.

IC Markets is revolutionising the way people trade on the internet. Traders now have access to prices previously only available to investment banks and wealthy people

Regulatory Commitment

The importance of following all applicable laws, rules, regulations, policies, and standards is recognised by IC Markets. IC Markets is committed to strict management rigour and top-notch controls. As a regulated business, it is required to adhere to stringent financial standards, such as capital adequacy and audit requirements.

IC Markets holds customer money in client-segregated trust accounts with top-tier Australian institutions. Client money are kept separate from IC Markets’ company funds and managed in accordance with the Client Money Handling laws. Client money is never used for operational expenses or goals.

Investment Opportunities

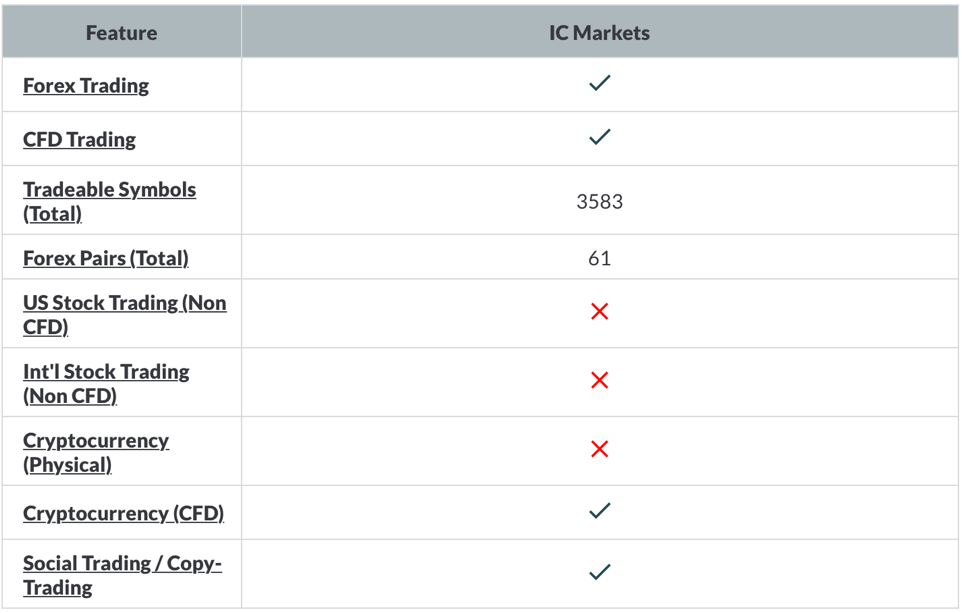

The Australian, Cyprus, and Seychelles offices of IC Markets provide a total of 291 tradeable items. The table below lists the numerous investment packages that IC Markets offers to its customers.

CFDs enable you to trade cryptocurrencies, but you can’t directly trade the underlying asset (e.g., buying Bitcoin). Crypto CFDs are not available to retail traders or UK citizens through any broker’s UK operation.

Fees and commissions

Overall, owing to small deposit requirements for both commission-based accounts and moderate effective spreads, IC Markets keeps up with the best forex brokers for low trading costs, such as Saxo Bank, IG, and CMC Markets.

Trading charges differ amongst the three account types offered by IC Markets. The Standard account is fee-free (spread alone), whereas the Raw Spread and cTrader accounts include commission-based pricing (spread + commission).

The cTrader account has a tenth of a pip lower commission than the Raw Spread account, making both accounts equivalent. The most significant distinction is the platform that may be used. For example, the Raw Spread account, which employs MT4 or MT5, charges $3.5 each side or $7.00 per round turn for every 100k units (1 standard lot) (RT). On cTrader, however, it costs $3.0 each side or $6.00 for a normal RT.

Effective spreads: IC Markets offers an average spread of 0.1 pips on the EUR/USD. After adding the commission equivalent to 0.6 pips on the cTrader account, the all-in expenditures would be 0.7 pips (or 0.8 on MetaTrader on the Raw Spread account), which is competitive.

IC Markets also gives a monthly bonus to traders who trade more than 100 standard lots, comparable to an active trader bonus. The commission-free basic account, with average spreads of 1.1 pips on the EUR/USD, is a less enticing option when compared to the other two commission-based account types.

IC Markets executes orders on an agency basis, which means there are no requotes or quick execution, therefore orders may be susceptible to positive or negative slippage.

Platforms and Tools

IC Markets is particularly well-suited to algorithmic traders due to its execution methods (i.e., no requotes) and the ability to execute orders inside the spread. Both the MetaTrader and cTrader platform suites are available, as well as copy-trading systems. In this year’s Best MetaTrader Brokers category, IC Markets is a solid contender.

For web and desktop trading, IC Markets offers MT4 and MT5. For the desktop versions, the Advanced Trading Tools package, as well as the AutoChartist and Trading Central plugins, are available as add-ons. These plugins must be installed separately, but they are definitely worth the effort to improve the default experience MetaTrade.

MetaTrader Tools: IC Markets offers the FX Blue LLP-developed Advanced Trading Tools add-on, as well as installable plugins from Trading Central and AutoChartist.

cTrader platform: IC Markets offers both web-based and desktop versions of its cTrader platform. Several trading apps are included in the cTrader suite, including cAlgo, which is used for automated trading, and cTrader Copy, which is used for social copy trading. Note that the broker’s European brand, IC Markets EU, does not provide cTrader.

VPS service: The broker offers many third-party Virtual Private Servers (VPS) services to host client algorithms for traders who trade at least 15 standard lots.

Social copy trading: In addition to cTrader Copy and MetaTrader’s native Signals market, IC Markets’ Myfxbook and ZuluTrade platforms for copy trading are available across all of its global brands.

MetaTrader 4

Even if the Metatrader 4 platform feels outdated and sometimes it can be difficult to find some features, it’s very easy to customise. Like Webtrader, it only supports one-step authentication.

Mobile trading

Each of IC Markets’ three platforms offers a mobile version, including MetaTrader 4, MetaTrader 5, and cTrader, which are all accessible on iOS and Android. The lineup is impressive, but it’s worth remembering that mobile behemoths like Saxo Bank, CMC Markets, and TD Ameritrade all provide bespoke trading apps.

On mobile, the MetaTrader and cTrader platforms provide equal functionality and charting. Which platform you choose on the desktop version will most likely be determined by whether you trade manually or with automated trading systems.

Funding and withdrawal

Once you’ve completed the Demo and are ready to finance a live account, there are several options available to you.

The following currencies can be used to fund your account: AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF. Directly from your IC Markets admin area, you may fund your account.

According to the data above, the most convenient way to fund your account is to use a credit card or an online wallet of some sort. It should just take a few seconds for them to clear.

The approach with the largest lag time is wire transmission. This might take up to two days, depending on where your bank is located.

Withdrawals are as simple as making a deposit into your account. Fill out the online withdrawal form on your account management panel.

In terms of money, you may use many of the same strategies that you used before. If you used an online wallet, this is most likely the quickest approach. Wires might take up to two days to arrive, providing you provided accurate information.

Customer Support

Bad customer service damages a trading experience more than anything else!

So, how does IC Markets stack up against its rivals?

They offer a number of support desks across the world with native English and Chinese speakers on staff. You may reach out to their reps through a variety of methods.

To contact them, you may send an email to support@icmarkets.com, for example.

For Chinese consumers, they also have a support.cn@icmarkets.com email address.

You may also contact them using their live chat option. If you want to talk to someone on the phone, they also have a phone option. In Australia, they have a toll-free number (+1300 600 644) as well as a Chinese contact. number, +86 400 609 6783.

Pros

- Fast and Easy to Open and Fund an account

- Very fast deposit and withdrawal methods

- Strong education section with more than 50 video tutorials

- World's biggest and most trusted brokers

- Acess to ZuluTrade copy trading platform

Cons

- Bigger swaps than some competitors

- Poor webtrader platform

World's most trusted broker

- IC Markets is able to offer market best possible pricing and some of the best trading conditions through the MT4 platform

- MetaTrader 4/5 – Fast Order Execution server is located in the Equinix NY4 data centre in New York

- Flexible Funding and Withdrawal Options

- Superior Technology IC Markets has partnered with the world’s best trading technology companies to bring you the ultimate trading experience and cutting edge trading tools.

- Social Trading Platform. Choose among 100.000 talented ZULU Traders from 192 countries and follow their trading signals for FREE in your account.

Join the world's biggest and most trusted broker